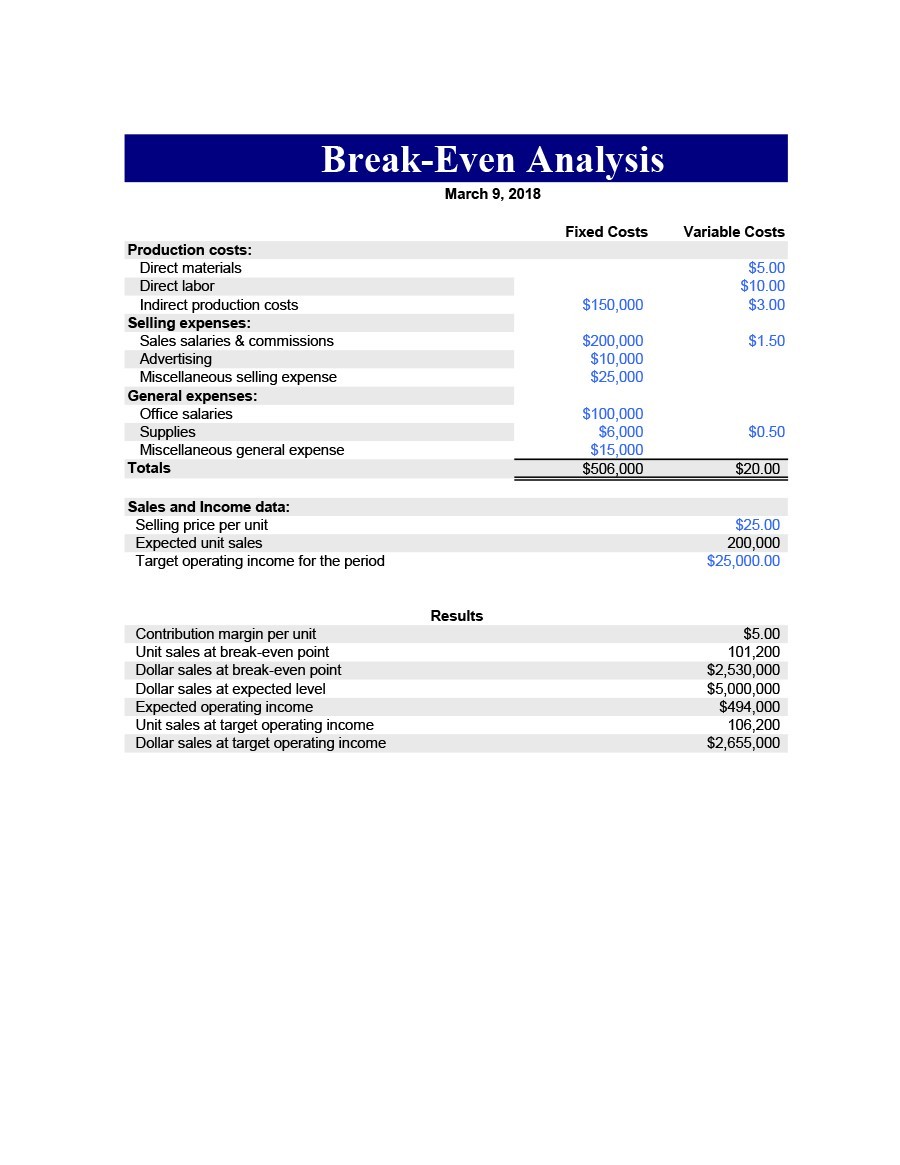

If the market pricing for a particular product does not allow the business to break even, then the business should not pursue this as a source of potential profit.īreak-even point analysis is also typically performed during routine monitoring and profitability analysis. It is typically used in conjunction with market research performed on comparable goods or services to understand consumer sentiment and pricing indexes. Of course, it is most valuable when used to assess profitability or as part of a larger profitability analysis but it is helpful in other less obvious ways as well.įor example, most pricing models rely on break-even analysis to help gauge an appropriate price for each unit, and a break-even analysis assumes that. Understanding the point at which your business becomes profitable is important in itself but there are other benefits to performing routine break-even analysis. Later in the article, we’ll discuss how to prepare a break-even analysis and discuss the assumptions of break-even analysis. At a glance, if revenue is below the break-even point, then the business is not profitable. In its simplest form, break-even analysis reveals the point at which a company or one of its revenue streams will become profitable, thus why many companies have break-even financial statements. The process of both calculating and understanding the costs that impact the break-even point helps to determine the appropriate amount to charge for each unit of production. This type of analysis is concerned predominantly with how many units need to be sold at a specified price to cover all fixed and variable expenses. Here’s a break-even analysis definition: analyzing the point at which revenue equals cost is referred to as break-even analysis. What follows is a quick guide to break-even analysis and a break-even analysis formula. This is often a part of a cost-volume-profit analysis (CVP) because a CVP will reveal a break-even point.

This is because the concept of breaking even is used to guide decision-making well before a business is even established. The primary purpose of every business is to make a profit and break-even analysis is used to help design pricing models that can accomplish this.Īmong the various analytical approaches to financial modeling and scenario analysis that business leaders take, break-even analysis has one of the largest impacts on decision-making. One of the primary concerns of any business, big or small, is when they will break even.

0 kommentar(er)

0 kommentar(er)