Historically, many taxpayers have reported gains from M&A transactions using the installment method. 2 Despite receiving installments over time, however, the seller can elect out of the installment method of recognizing gain for tax purposes and choose instead to report the entire gain in the year of the sale. 1 If part or all of the consideration in a sale transaction is received in a subsequent year from the seller's tax year in which the sale's distribution of property occurs, the seller generally reports gain as proceeds are received under the installment method. M&As came roaring back in the second half of 2020, however, and the trend is projected to continue through 2021. Merger-and-acquisition (M&A) activity essentially ground to a halt in early 2020 in the face of the uncertainty associated with COVID-19. Although taxpayers may not elect out of the installment method retroactively, they may accelerate gain if desired, by disposing of the note receivable.Possible reasons not to elect out, i.e., to use the installment method, include the difficulty and costs of raising cash to pay the tax in the year of the sale, being able to take advantage of an expected lower future capital gains rate, to better absorb losses from other sources or from a purchaser's default, and complications of valuing contingent consideration in the year of sale.Others include reducing an estate's valuation by the amount of the tax payment, avoiding an interest charge on deferred tax, sheltering gain by reinvesting it in a qualified opportunity zone fund, accelerating basis recovery, and absorbing loss carryovers that will expire soon.

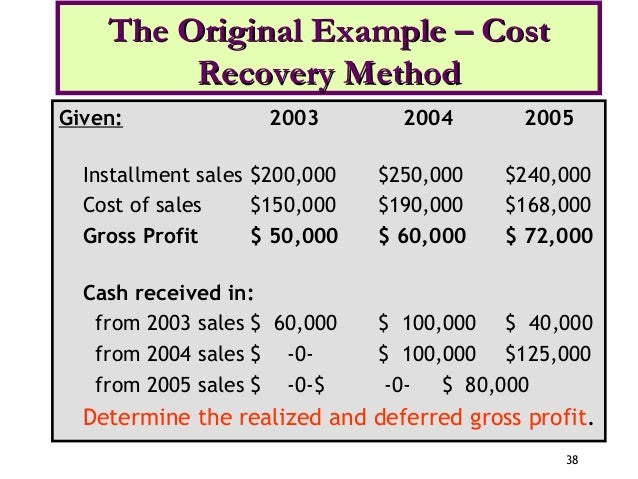

Taxpayers selling businesses or assets in an installment sale often recognize gain under the installment method as installments are received.

0 kommentar(er)

0 kommentar(er)